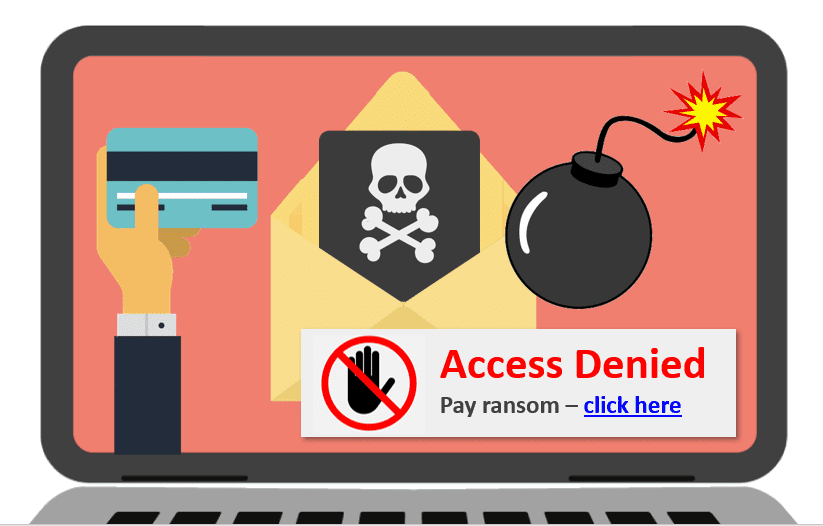

Empowering Financial Professionals to Combat Financial Crimes

We are delighted to announce the launch of our CPD-certified Anti-Money Laundering (AML) Training course. It’s designed to equip professionals with the knowledge and tools to combat financial crime and ensure compliance with the Money Laundering, Terrorist Financing, and Transfer of Funds Regulations (MLR) 2017.

This online course guides on identifying, preventing and reporting suspicious financial activities, helping businesses combat financial crime and ensure compliance with MLR 2017.

Why Is This Course Important?

Money laundering is a global issue with devastating consequences. According to the United Nations, an estimated £600 billion to £1.57 trillion in illicit funds are laundered annually, with 40% passing through London alone. This money fuels illegal activities such as terrorism, drug trafficking and weapons smuggling.

Under UK law, businesses must adopt a risk-based approach to combat money laundering. This course ensures your team understands their obligations and can take proactive steps to identify, prevent and report illegal transactions.

This course helps professionals meet their duties by:

- Explaining key legislation and compliance requirements

- Highlighting money laundering risk factors

- Outlining prevention strategies

Who Is This Course For?

This course is ideal for:

- Employees in High-Risk Financial Sectors: Professionals handling large financial transactions and exposed to high-risk areas.

- Accountants and Auditors: Financial experts responsible for maintaining transparency and ensuring the legitimacy of financial records and practices.

- Estate Agents: Property professionals who must comply with regulations while handling transactions involving high-value assets.

- Lawyers and Legal Professionals: Legal advisors tasked with safeguarding clients and firms from financial crime.

- Customer Service and Sales Staff: Frontline employees who interact with clients purchasing high-value goods.

- Compliance Professionals: Specialists dedicated to implementing policies and ensuring compliance within an organisation.

If your role involves large financial transactions, this training will provide you with the skills and knowledge to safeguard your organisation against money laundering.

What Will You Gain?

By completing this course, users will understand:

- What money laundering is and how it happens

- How to comply with UK money laundering legislation

- Best practices for preventing, identifying and reporting suspicious activities

- Customer due diligence and other key compliance strategies

- High-risk areas, sectors, and activities

- Their role in preventing money laundering

Course Outline

To read the complete course outline, click here.

How to Enrol

Help protect your business and ensure compliance. Enrol in our CPD-certified Anti-Money Laundering Training today.

Have Questions?

If you have any questions or need more information about the course, please feel free to contact us. We’re here to help.