All professionals and businesses that handle large transactions are dutybound to detect and report money laundering. But how do you separate criminals from legitimate clients?

This guide explains how to detect money laundering. It provides an overview of your duties and outlines the procedures you need in place to identify illegal financial activity.

Key Takeaways

- Businesses that handle large transactions have a duty to detect and prevent money laundering.

- Suspicious customer behaviour includes refusal to provide identification, using third parties or hiding reasons for transactions.

- Unusual or complicated transaction patterns, such as frequent cash deposits, large one-off payments or rapid fund transfers, are also often indicators of illegal activity.

- Monitoring the source of funds is essential – look for unexplained wealth, third-party payments or large, unexplained cash deposits.

- Concerns must be reported to the National Crime Agency if there are reasonable grounds to suspect money laundering.

What Money Laundering Is

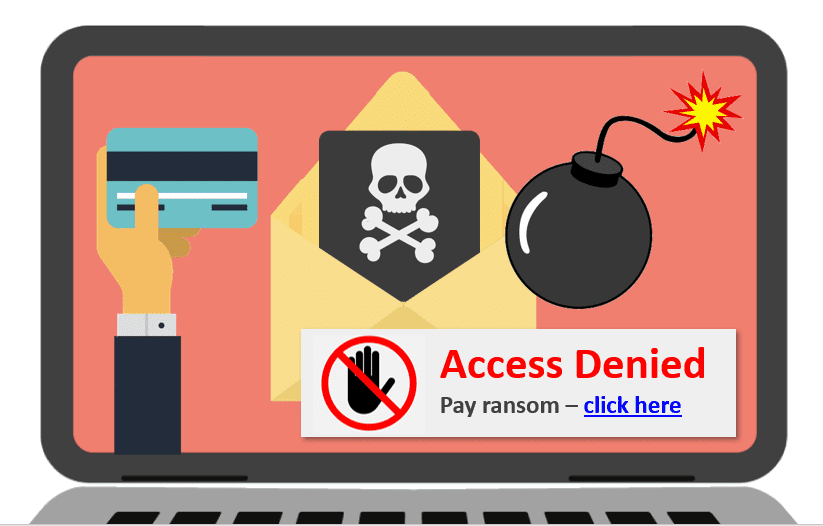

Money laundering is the process of disguising illegal funds to make them appear legitimate. There are different types of money laundering, but they broadly follow the same pattern: criminals introduce their illegal funds into the financial system and move them through transactions to hide their origin.

There are typically three stages of money laundering:

- Placement – Illegal funds are introduced into the financial system through businesses or other transactions.

- Layering – The money is moved around through complex transactions, creating multiple “layers” to hide the actual source.

- Integration – The “cleaned” money re-enters the legitimate economy, disguised as income, investments or assets that can be freely used.

The consequences of money laundering can be dire. It funds further illegal activity, including organised crime and even terrorism. It also robs public services of much-needed funds, erodes trust in financial institutions and puts businesses at risk of being exploited.

In the UK, money laundering is a significant issue. The National Crime Agency (NCA), which leads the fight against money laundering, doesn’t actually know how much criminal cash infiltrates the British economy each year. Its official estimate is between £36 and £90 billion, but the agency admits the actual figure could be hundreds of billions.

Stopping this flow of illegal funds is critical for protecting businesses and society at large.

Who Has a Duty to Detect Money Laundering

The duty to detect money laundering comes from the Money Laundering, Terrorist Financing and Transfer of Funds Regulations 2017 (MLR 2017).

MLR 2017 applies to all professionals and businesses handling large transactions.

Regulated Sectors

The following businesses and individuals are legally required to detect and prevent money laundering:

- Financial services: Banks, credit unions and other financial institutions.

- Lawyers and accountants: Professionals involved in handling large transactions, property purchases or managing client assets.

- Estate agents: Those facilitating property sales, particularly where large sums of cash are involved.

- High-value dealers: Businesses accepting payments of €10,000 or more in cash. (MLR 2017 started as an EU directive, so it uses Euros as the default currency.)

- Crypto service providers: Those involved in virtual currency exchange or wallet services

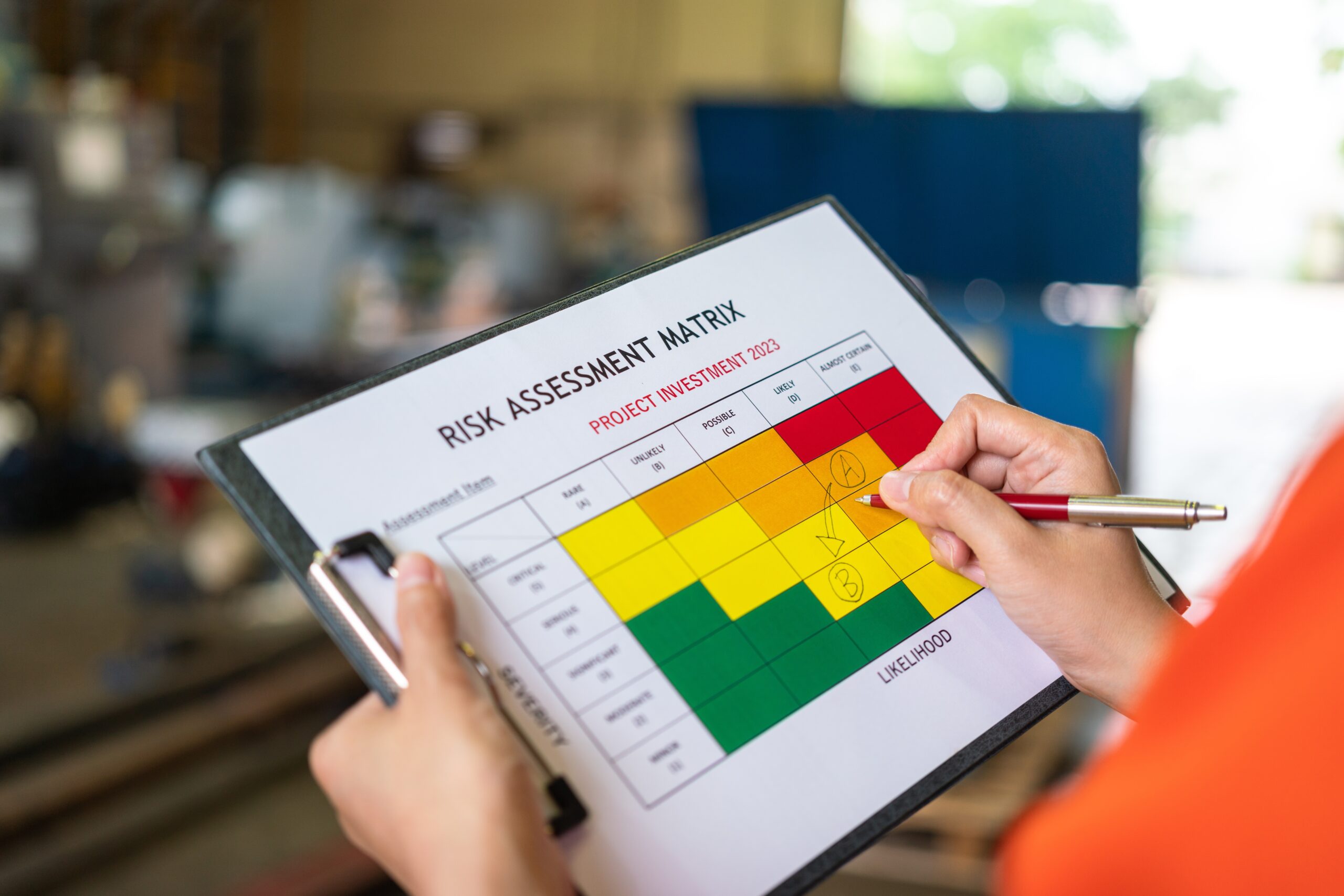

The Risk-Based Approach

MLR 2017 requires a risk-based approach to money laundering prevention. Businesses must try to identify and report illegitimate transactions before any criminal funds can change hands and slip into the system.

In practice, you need to carry out money laundering risk assessments for your clients and the transactions you enable. Based on the risk level, you then apply appropriate measures to detect and prevent money laundering. Standard risk controls include:

- Conducting appropriate customer due diligence checks for new clients.

- Applying enhanced checks for high-risk clients and transactions.

- Monitoring ongoing business relationships for any unusual changes in activity.

How to Detect Money Laundering

Understanding how to detect money laundering is essential for businesses and professionals tasked with preventing financial crime.

By recognising these common signs of money laundering, you can identify illegal transactions and take appropriate action.

Customer Behaviour

Unusual or evasive behaviour from customers often signals a problem. Look out for:

- Refusing to provide identification or providing false or incomplete documents.

- Using intermediaries or third parties to obscure their identity.

- Requesting services or transactions that don’t fit their customer profile.

- Hiding reasons for transactions, particularly large ones.

Transaction Patterns

Certain transaction patterns are strong indicators of money laundering. Pay attention to:

- Frequent cash transactions involving large sums or unusual denominations.

- Breaking large transactions into smaller amounts to avoid detection (known as “structuring”).

- Rapid movement of funds between multiple accounts, especially across jurisdictions.

- Transactions with no clear purpose, such as sending money to unrelated third parties.

- Transactions to or from high-risk countries with little or no justification.

Source of Funds

Understanding where a customer’s money comes from is essential. Be wary of:

- Unexplained wealth or sudden changes in financial status, such as large deposits without a clear origin.

- Payments made by third parties who are not directly involved in the transaction.

- Using cash in sectors or situations where it’s unusual, such as property or large service contracts.

Red Flags for Existing Customers

Customers who pass due diligence and have a history with your organisation shouldn’t automatically be considered safe. Their activities still need to be monitored. Watch for:

- Changes in transaction behaviour that don’t match their typical patterns.

- Unusual account activity, such as sudden increases in transaction frequency or size.

- Reluctance to provide updated documents for regular due diligence checks.

By staying alert to these behaviours and patterns, you should effectively identify potential money laundering. If you notice any red flags, you must report your suspicions to the proper authorities.

Where to Report Money Laundering

If you suspect money laundering, it’s essential to report your concerns as soon and accurately as possible. Failure to do so can lead to serious legal consequences.

Suspicious Activity Reports

When you know or have reasonable grounds to suspect that money laundering is taking place, you must notify the National Crime Agency in the form of a suspicious activity report (SAR).

The SAR provides details about the suspicious activity, enabling the NCA to investigate further.

When to Submit a SAR

You must submit a SAR when:

- A customer’s actions or transactions raise reasonable suspicion of money laundering.

- You cannot verify the source of funds or the legitimacy of a transaction.

- A customer’s behaviour or financial activity is inconsistent with what you know about their business or personal profile.

How to Submit a SAR

To report suspicious activity:

- Collect all relevant details about the transaction, the customer and your reasons for suspicion.

- Submit the SAR through the NCA’s secure online portal.

- Avoid alerting the customer or others involved – this is known as “tipping off” and is a criminal offence.

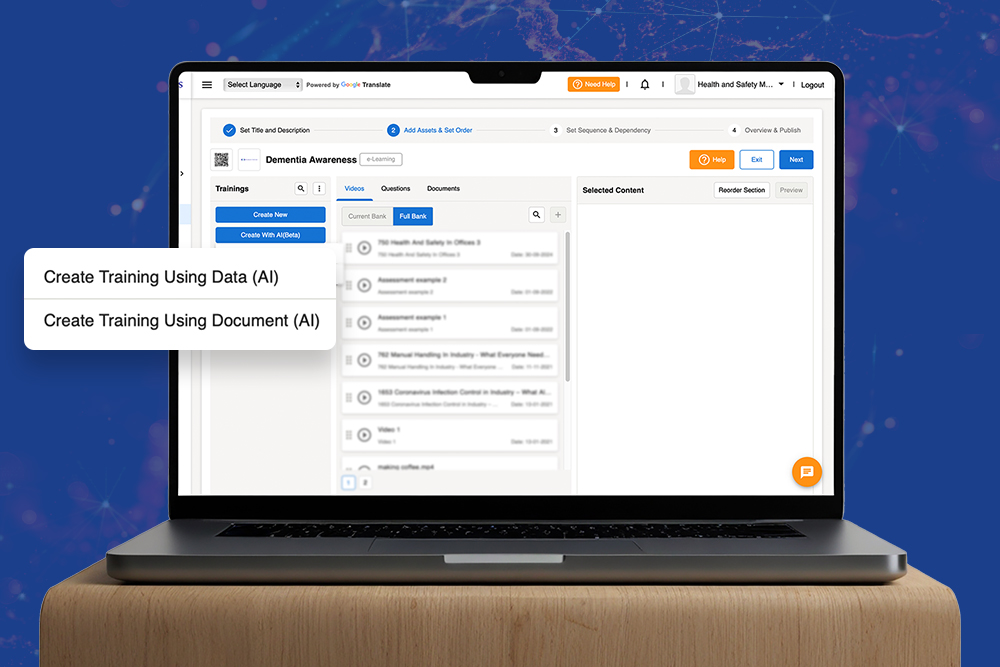

Anti-Money Laundering Training

Meeting your legal duty to detect and report money laundering requires ongoing awareness and action.

Our online Anti-Money Laundering Training course will equip your team with the knowledge to detect, prevent and report suspicious activities effectively.

After completing the course, users will:

- Understand how to detect money laundering using the risk-based approach.

- Know when to apply enhanced customer due diligence checks.

- Recognise red flags and suspicious behaviours associated with criminal activity.

Safeguard your business and ensure compliance with MLR 2017. Enrol in online Anti-Money Laundering Training today.