Whether it’s cash or crypto, the money laundering process is always the same. Criminals inject illegal funds into the financial system before recouping them as legitimate assets or cash, ready for reinvestment in further illegal activity.

But how many stages of money laundering are there? And when are criminals most exposed?

This guide breaks down the three stages of money laundering and the legal duties to combat it. If you work in finance or handle large transactions, you’re dutybound to monitor and report any suspicions of money laundering. Learning how many stages of money laundering there are will help you identify illegal financial activity when criminals are most vulnerable.

How Many Stages of Money Laundering Are There – Key Takeaways

- Money laundering involves three stages – placement, layering and integration – with the first two offering the best chances for detection.

- Successfully laundered money is difficult to trace, so businesses must take steps to prevent money laundering at the earliest stage possible.

- The Money Laundering Regulations 2017 (MLR 2017) require businesses to adopt a “risk-based” approach to money laundering prevention.

- High-risk transactions require enhanced scrutiny, including verifying the source of funds.

- Money laundering suspicions must be reported to the National Crime Agency (NCA).

What is Money Laundering?

Money laundering is disguising criminal proceeds as legitimate funds.

The basic process is always the same: criminals place dirty money into the financial system, where it’s laundered before emerging as clean money, either invested in legitimate assets or ready to spend.

Most money laundering schemes start with cash, as criminals still prefer paper money. However, assets or cryptocurrency can also be used during the money laundering process.

Why is Money Laundering a Problem?

Criminals launder dirty money so it can be spent without detection. Laundered money can be used to fund obscene lifestyles or reinvested into some of the worst crimes, including the drug trade, human trafficking or even terrorism.

In an attempt to cut criminal funding, the UK government has made the detection and prevention of money laundering a legal duty for businesses handling large transactions vulnerable to criminal exploitation.

Under the Money Laundering, Terrorist Financing and Transfer of Funds Regulations 2017, regulated businesses must take steps to protect against money laundering.

To prevent criminals from exploiting your business, you must adopt a risk-based approach. Essentially, you have to carefully examine customers and transactions for any signs of money laundering.

How Many Stages of Money Laundering Are There?

There are three stages of money laundering. These are:

- Placement – dirty money is introduced into the financial system.

- Layering – the dirty money is moved around to obscure its origin.

- Integration – the dirty money is successfully cleaned or invested.

After integration, it’s extremely difficult to distinguish criminal money from legitimate funds, which is why regulated businesses are expected to monitor the transactions they handle. It’s easiest to spot money laundering when it’s first placed into the financial system. The multiple transactions involved in the layering stage also present opportunities for detection.

Placement

Before criminals can launder their money, it needs to be introduced into the financial system. This first stage is known as placement.

Placement is the riskiest stage for criminals laundering money, as it typically involves large, one-off cash transactions. To avoid suspicion, criminals try to exploit industries where sizeable cash deposits won’t stand out.

Common placement techniques include:

- Exchanging cash for money orders or prepaid cards

- Buying large sums of casino chips and cashing them in without actually gambling

- Physically smuggling money into jurisdictions with looser financial regulations

- Channelling money through cash-intensive businesses, such as car washes

- Purchasing high-value assets, such as property, vehicles or jewellery

Criminals can also circumvent suspicion by placing dirty money in a series of smaller transactions as opposed to a single large one. This money laundering technique is known as structuring or smurfing.

Using criminal proceeds to buy something seems like successful money laundering. But it’s relatively straightforward to trace where illegal funds have come from if they’ve only been used in one transaction. Criminals need a longer, more confusing paper trail to throw authorities off, which is where layering comes in.

Layering

Layering sees the dirty money pass through multiple transactions to hide its origin.

This stage of the money laundering process can see dirty money:

- Exchanged into different currencies

- Transferred across borders

- Routed through off-shore shell companies

Generally, the more “layers” the better for criminals. Dense, complex transaction histories can confuse or delay authorities looking into the money’s origin.

Integration

Integration is the end goal of any money laundering process. It sees illicit funds successfully cleaned and integrated into the legitimate financial system. At this stage, criminals are free to spend their money without raising suspicion.

Successfully integrated money can be:

- Invested into businesses, properties or high-value assets like art or jewellery

- Deposited directly into criminals’ bank accounts, appearing as legitimate earnings

- Reinvested into further criminal enterprises

What Can Be Done After Criminal Money is Laundered?

Once money has been successfully laundered, it’s incredibly challenging to trace. By the time it reaches the integration stage, the funds have passed through multiple transactions, bank accounts, currencies or even countries. Working backwards through this chain of events takes considerable time, resources and personnel – a fact that criminals exploit.

Even if authorities suspect money laundering, proving it is another challenge. On paper, it’s nearly impossible to separate clean money from criminal proceeds if it’s gone through multiple “legitimate” transactions.

Because recovering laundered money is so difficult, the Money Laundering, Terrorist Financing and Transfer of Funds Regulations 2017 prioritise prevention over enforcement. Businesses handling high-risk transactions are expected to detect money laundering before criminals reach the integration stage.

How Can You Prevent Money Laundering?

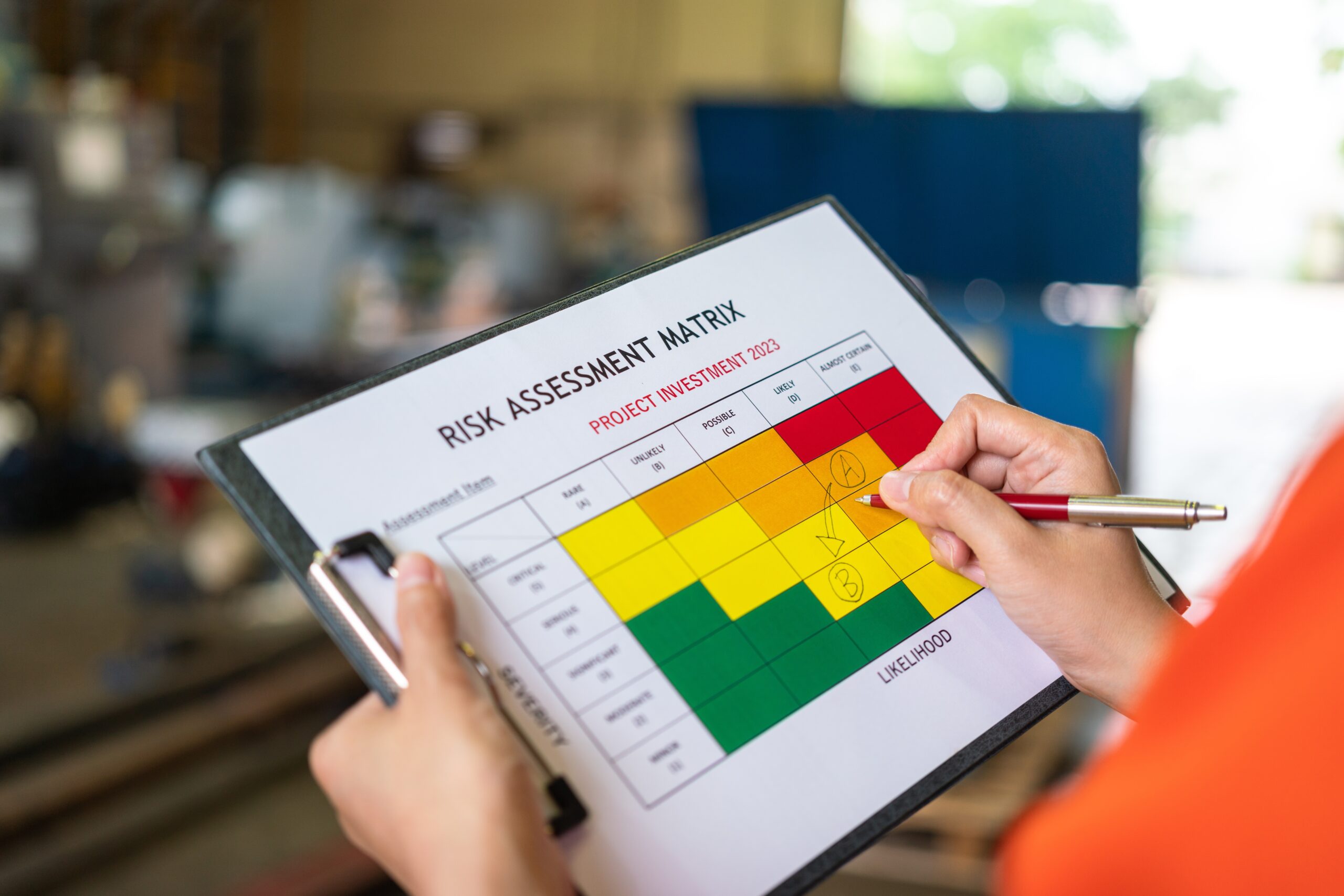

As mentioned, the Money Laundering, Terrorist Financing and Transfer of Funds Regulations 2017 require regulated businesses to adopt a risk-based approach to financial crime prevention.

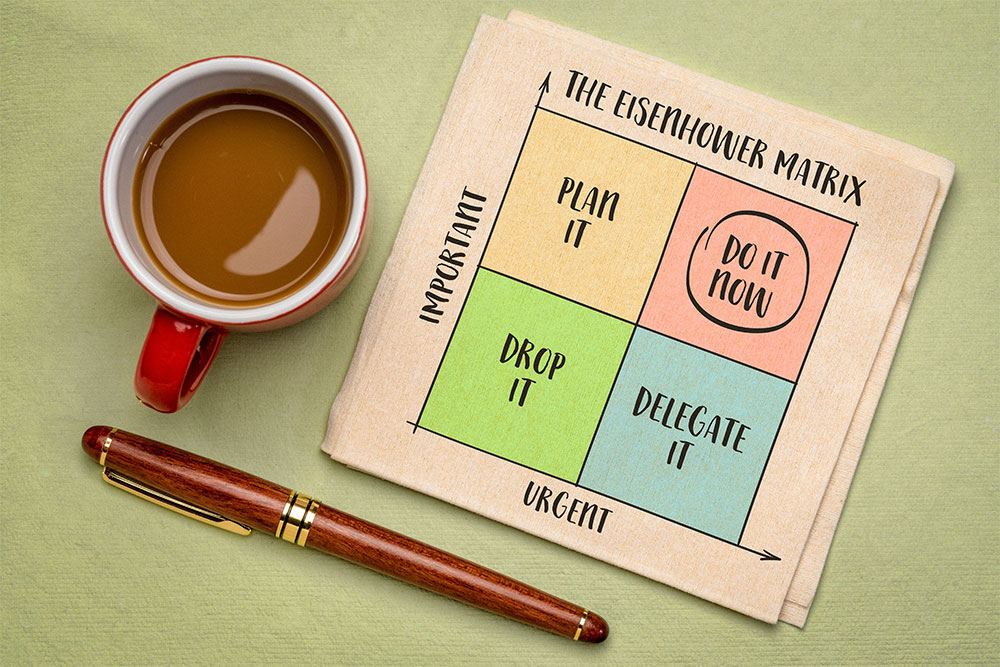

A risk-based approach means focusing resources where the threat of money laundering is highest. Instead of treating all transactions equally, businesses must assess the level of risk posed by each customer, transaction or business relationship. The higher the risk, the more scrutiny is required.

To comply with MLR 2017, you must:

- Assess risk – Identify transactions, customers and business relationships that pose a higher risk of money laundering.

- Implement controls – Put safeguards in place, such as customer due diligence (CDD) and enhanced due diligence (EDD) for high-risk clients.

- Monitor transactions – Scrutinise financial activity for suspicious patterns or unusual customer behaviours that might indicate money laundering.

- Report concerns – Submit suspicious activity reports (SARs) to the National Crime Agency when potential money laundering is identified.

Businesses aren’t expected to investigate financial crimes themselves, but they are legally required to act when they have reasonable grounds to suspect money laundering.

Anti-Money Laundering Training

To meet your legal duty to prevent money laundering, you and your team must be able to identify high-risk transactions.

Our online Anti-Money Laundering Training course will help you spot the warning signs of financial crime and ensure compliance with money laundering regulations.

The course covers:

- Applying the risk-based approach required by MLR 2017

- How many stages of money laundering there are

- Money laundering red flags that require greater scrutiny

- Anti-money laundering policies and processes

- Reporting procedures for reasonable suspicions

The course is entirely online, so learning is self-paced and easy to share across your organisation. And everyone who completes the course earns a CPD-certified training certificate.

Prove you’ve acted on your duty to prevent financial crime and purchase online Anti-Money Laundering Training today.