Money laundering is big business in the UK. Around 40% of the £1.5 trillion laundered globally each year passes through London. In response, the government has made tackling financial crime a priority.

Any business that handles large sums must vet clients and transactions for money laundering risks. These anti-money laundering (AML) checks are designed to detect and prevent criminal funds from entering the economy.

This guide explains what anti-money laundering checks are, the laws behind them and what businesses must do to stay compliant.

Key Takeaways

- Money laundering regulations require businesses to identify and manage attempted money laundering using a risk-based approach.

- Anti-money laundering checks involve customer due diligence, risk assessments and enhanced due diligence for high-risk clients.

- AML checks are essential to comply with UK law and protect businesses from financial crime.

What is Money Laundering?

Money laundering is making illegal funds appear legitimate. Criminals obscure the origin of their “dirty” cash by purchasing “clean” assets, which can then be exploited to disguise profits gained from illicit activities.

The consequences of successful money laundering are far-reaching. It funds organised crime, corruption and even terrorism while starving public services of much-needed revenue.

To stop this, the government enforces strict anti-money laundering regulations on all organisations handling large transactions.

What’s the Law on Money Laundering?

The UK has several laws to combat money laundering, but the Money Laundering, Terrorist Financing and Transfer of Funds Regulations 2017 (MLR 2017) is the most significant.

Under MLR 2017, businesses in regulated sectors must adopt a risk-based approach and implement checks to identify and manage money laundering risks.

Two key agencies play distinct roles in enforcing these regulations:

- The Financial Conduct Authority (FCA): The FCA ensures businesses comply with MLR 2017 and implement the necessary AML checks.

- The National Crime Agency (NCA): The NCA investigates and disrupts money laundering. Businesses must report any suspicious financial activity to the NCA via a suspicious activity report (SAR).

Financial Action Task Force

The Financial Action Task Force (FATF) is an international organisation founded to combat money laundering and act as a terrorist financing watchdog. It recommends ways countries, including the UK, can strengthen AML laws.

FATF recommendations largely align with MLR 2017, reinforcing the need for a risk-based approach to money laundering. However, the UK’s AML laws aren’t considered the gold standard.

A 2018 report from the FATF found several weaknesses, including gaps in the supervision of regulated sectors and insufficient resources to act on suspicious activity reports.

Since this assessment, the UK has bolstered its money laundering regulations and agencies. The FATF has now revised its position, stating that the UK has made significant progress, particularly in expanding the scope of regulations and strengthening AML enforcement. UK businesses are now under greater scrutiny, making compliance with AML checks and regulations more critical than ever.

Who Must Comply with Money Laundering Regulations?

Money laundering regulations apply to businesses and individuals in sectors at high risk of financial crime. These include:

- Financial services: Banks, building societies, credit unions and payment service providers.

- Legal professionals: Solicitors, notaries and other professionals managing client funds or property transactions.

- Accountants and auditors: Those handling financial records, tax advice and audits.

- Estate agents and letting agents: Businesses involved in buying, selling or renting property.

- High-value dealers: Businesses that accept cash payments of €10,000 or more. (MLR 2017 uses Euros because the legislation has roots in an EU directive.)

- Cryptocurrency exchanges and fintech companies: Those facilitating virtual asset transactions.

It’s not just large firms that must comply. Small and medium-sized businesses (SMEs) are also subject to the MLR 2017, even if they lack the resources of larger organisations.

What are Anti-Money Laundering Checks?

Anti-money laundering checks are processes businesses must follow to detect and prevent criminal funds from entering the financial system. These checks are designed to protect businesses, the economy and public services from financial crime.

We’ve summarised the most important AML checks below. To read about your legal duties in more detail, you can refer to the government’s guidance here: Money laundering regulations: your responsibilities.

What are Anti-Money Laundering Checks Used For?

Anti-money laundering checks are used to identify, assess and manage financial crime risks in line with the risk-based approach expected by MLR 2017.

In practice, AML checks ensure businesses understand who their customers are, the purpose of their transactions and whether their activities align with expectations.

Standard Anti-Money Laundering Checks

Due Diligence

Customer due diligence (CDD) is the first AML check. It involves knowing who your customer is, which is why it’s sometimes referred to as KYC – know your customer.

CDD includes:

- Identifying the customer: Verifying names, addresses and other key details using reliable, independent sources.

- Understanding the relationship: Confirming the purpose and intended nature of the transactions.

- Identifying beneficial owners: Establishing who ultimately owns or controls a company, trust or other entity.

Verifying this basic information ensures you understand who your customer is and the nature of their activities before proceeding with any transactions. It also provides the context needed to assess potential money laundering risks.

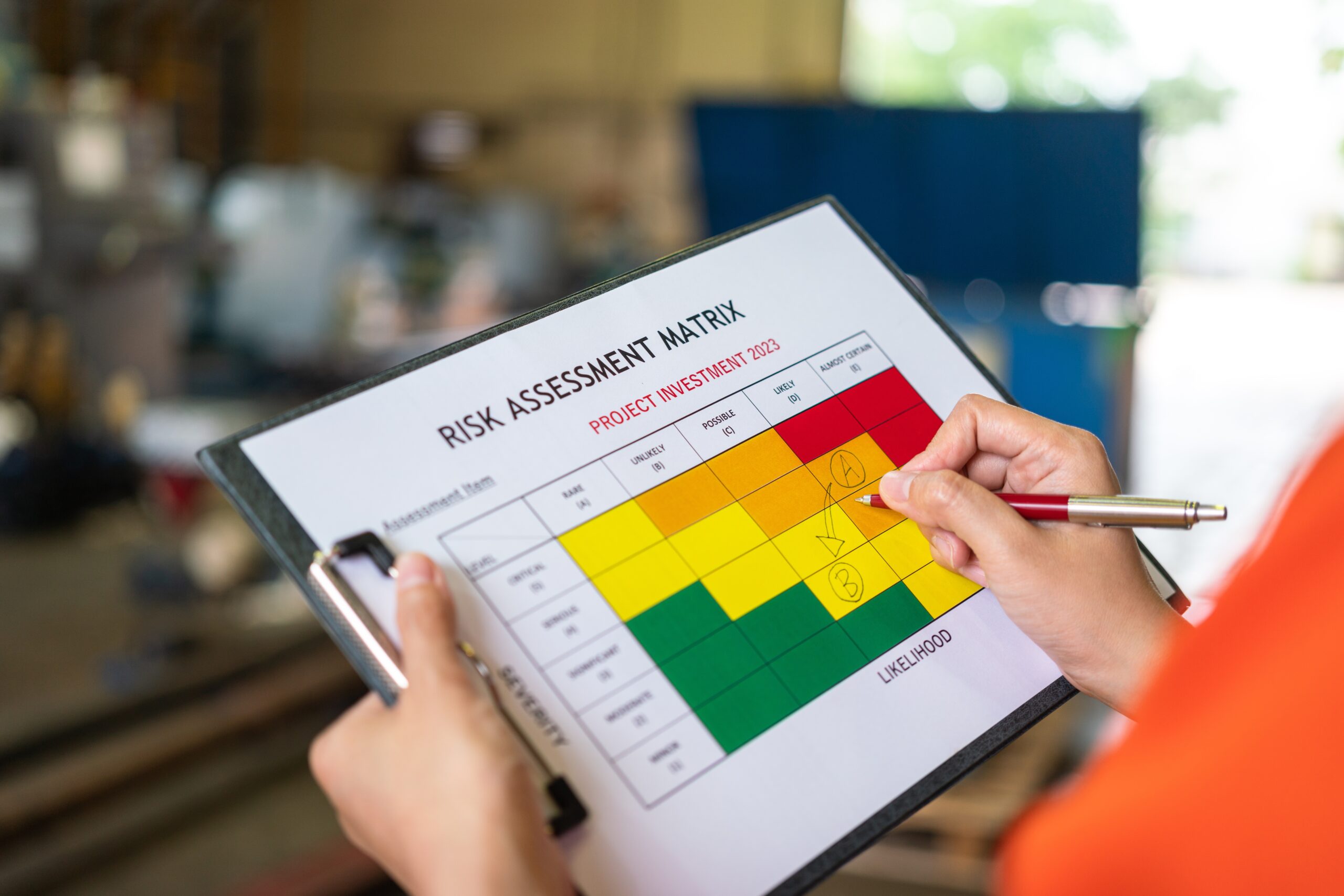

Risk Assessment

The information gathered during CDD should feed directly into your risk assessment. A risk assessment identifies the level of money laundering risk associated with each customer and informs how you handle the relationship.

Factors to consider include:

- Customer risk: Is the customer acting on behalf of others, or do they use complex ownership structures? Are you dealing with them in person or remotely?

- Geographic risk: Are they based in or connected to high-risk jurisdictions?

- Transaction risk: Are the transactions large, unusual or inconsistent with the customer’s profile?

Risk assessments ensure you apply AML checks proportionately, focusing greater attention on higher-risk customers or transactions.

Enhanced Due Diligence

If your risk assessment flags a customer as high-risk, you must apply enhanced due diligence (EDD). EDD builds on standard checks to provide a deeper understanding of the customer and their activities.

EDD measures include:

- Obtaining additional information: Verifying the source of funds, source of wealth and legitimacy of the customer’s activities.

- Ongoing monitoring: Closely reviewing transactions for unusual or suspicious activity.

- Senior management approval: Ensuring high-risk transactions are reviewed and approved at the senior level.

EDD ensures that higher-risk customers receive the extra scrutiny needed to detect and prevent financial crime.

AML Policy

An AML policy is not a check itself but a blueprint for preventing money laundering. It outlines the steps businesses have taken to comply with MLR 2017 and applies to all employees.

A good AML policy includes:

- Procedures for customer due diligence and risk assessments

- Processes for reporting suspicious activity

- Clear guidelines for staff training and compliance monitoring

Businesses must also appoint a money laundering reporting officer (MLRO). The MLRO oversees the implementation of the AML policy, ensures compliance and acts as the point of contact for reporting suspicious activity to the National Crime Agency.

What Anti-Money Laundering Checks are Recommended by FATF?

Recommendations from the FATF largely mirror the checks outlined in MLR 2017, including customer due diligence, risk assessments and enhanced due diligence for high-risk customers.

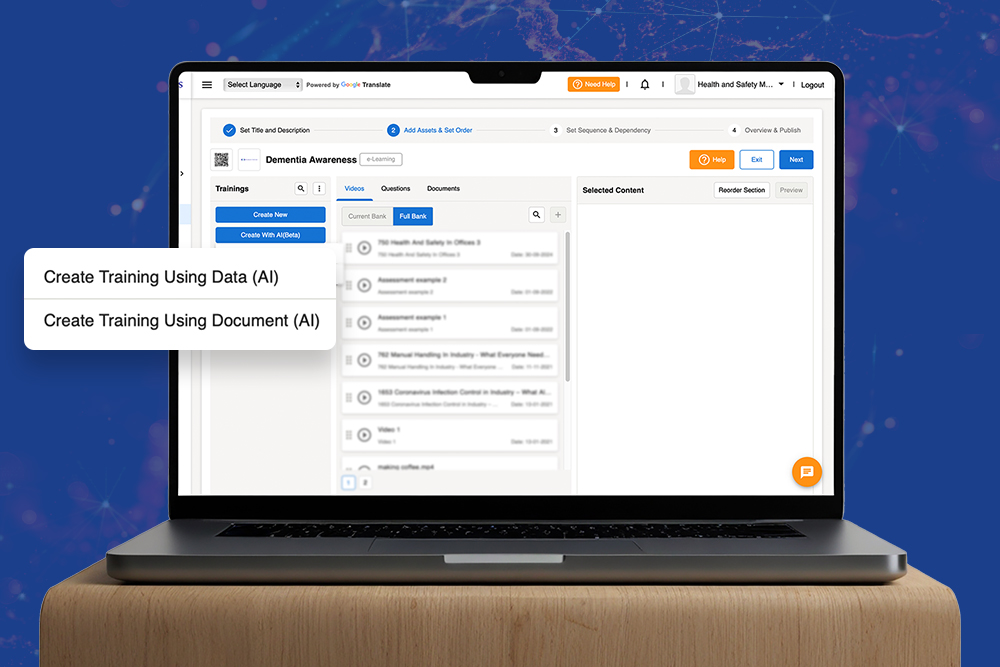

Anti-Money Laundering Training

Our online Anti-Money Laundering (AML) Training explains the different AML checks all regulated organisations must apply, including customer due diligence, risk assessments and enhanced due diligence.

The course covers:

- Key steps to compliance with MLR 2017

- Your responsibilities for ensuring AML checks are carried out correctly

- How to assess and manage money laundering risks to protect your organisation

Delivered entirely online, the course allows you to build organisation-wide awareness faster and demonstrates the proactive steps you’ve taken to meet legal AML obligations.