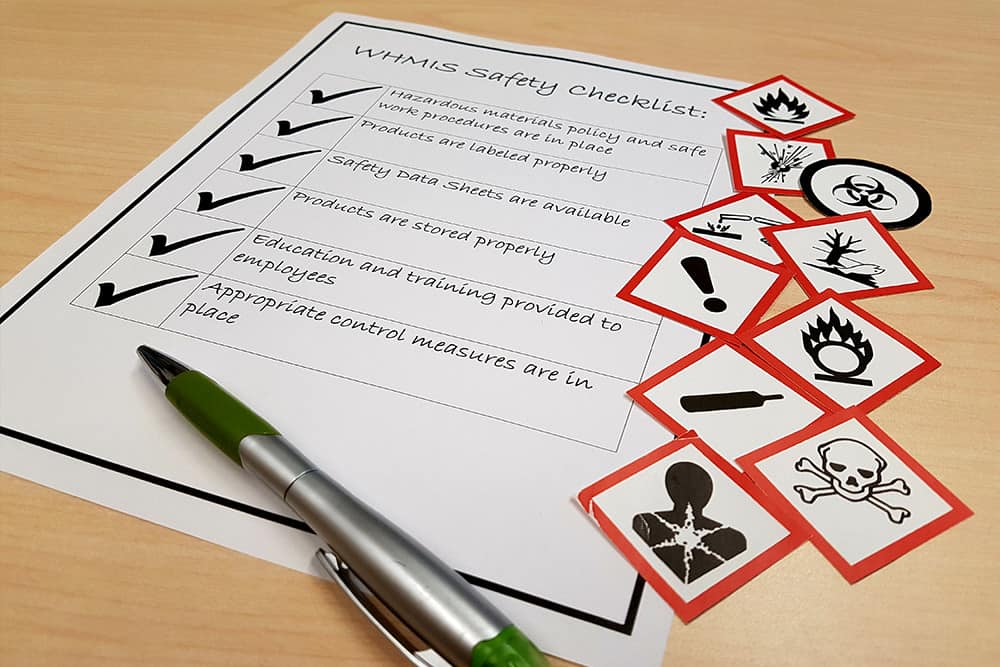

Businesses that handle payment card data must protect it from theft, fraud and unauthorised access. To ensure payment card data is safe, businesses must comply with the Payment Card Industry Data Security Standard (PCI DSS).

This guide explains 12 key requirements for achieving PCI DSS compliance. Any organisation that processes payment card transactions must understand and implement these requirements to protect customer data and reduce the risk of security breaches.

What is PCI DSS?

The Payment Card Industry Data Security Standard (PCI DSS) is a global security standard developed by the Payment Card Industry Security Standards Council (PCI SSC) to protect payment card data. It applies to all organisations that handle, process, or store payment card information, including merchants, financial institutions, and service providers.

The standard was first introduced in 2004 to address rising concerns about payment card data security. Since then, it has undergone multiple updates to keep pace with technological advancements and evolving threats. Each revision refined existing measures and introduced new requirements to strengthen data protection.

- PCI DSS v1.0 (2004): The first version provided basic security requirements for cardholder data protection.

- PCI DSS v2.0 (2010): Introduced more detailed guidelines, clarifying specific requirements and strengthening the overall framework.

- PCI DSS v3.0 (2013): Focused on reducing vulnerabilities and aligning with new industry practices. This version also encouraged businesses to take a more proactive approach to security.

- PCI DSS v3.2.1 (2018): Added more specific requirements for multi-factor authentication and securing cloud environments.

- PCI DSS v4.0 (2022): The latest major revision, which introduced a risk-based approach to compliance, allowing businesses more flexibility to tailor security measures to their specific environments. This version also expanded the scope of security measures and included stronger encryption and validation requirements.

PCI DSS Compliance Levels

There are four levels of PCI compliance, categorised by the number of annual credit or debit card transactions:

- Level 1: For businesses processing over 6 million transactions annually. It requires an annual internal audit by a PCI auditor and quarterly payment card industry (PCI) scans by an approved scanning vendor. PCI scans assess vulnerabilities in external-facing systems that process, store, or transmit payment card data.

- Level 2: For businesses processing between 1 million and 6 million transactions annually. It requires an annual self-assessment questionnaire (SAQ) and possibly quarterly PCI scans.

- Level 3: For businesses processing between 20,000 and 1 million transactions annually. It requires an annual SAQ and possibly quarterly PCI scans.

- Level 4: For businesses processing fewer than 20,000 e-commerce transactions or up to 1,000,000 in-person transactions annually. It requires an annual SAQ and possibly quarterly PCI scans.

PCI DSS Requirements

To achieve PCI DSS compliance, businesses must fulfil 12 essential requirements that guarantee the security of payment card data during every stage of the transaction process.

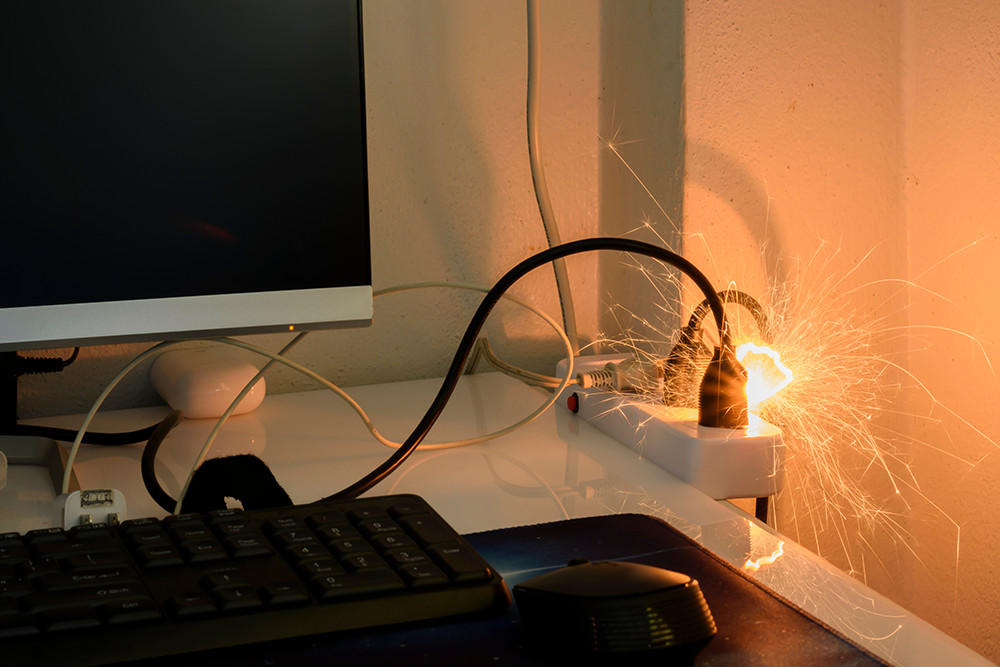

1. Install and Maintain Network Security Controls

Establishing robust network security controls, such as firewalls, is the first line of defence against unauthorised access to cardholder data.

Think of these controls as barriers between trusted internal networks and untrusted external networks. They filter traffic based on pre-set security rules. To ensure effectiveness, regularly update and configure these controls so that only legitimate traffic is allowed.

2. Apply Secure Configurations to All System Components

Default settings and passwords provided by vendors are common knowledge and can be exploited by attackers.

Avoid this risk by changing all default passwords and applying secure configurations to your hardware and software. This includes disabling unnecessary services and features.

3. Protect Stored Account Data

Use strong encryption methods to ensure that data remains unreadable if accessed without authorisation. Sensitive authentication data should never be stored after authorisation.

Additionally, mask primary account numbers (PANs) when displayed. Reveal only the last few digits to minimise exposure risks.

4. Protect Cardholder Data with Strong Cryptography During Transmission Over Open Networks

Transmitting cardholder data over open or public networks exposes it to interception.

Implement strong cryptographic protocols to encrypt the data during transmission. This ensures that even if data is intercepted, it cannot be read by unauthorised parties.

Regularly review and update your encryption methods to align with the latest industry standards.

5. Protect All Systems and Networks from Malicious Software

Malware is a significant threat to systems handling cardholder data.

Protect your systems by deploying and updating anti-virus and anti-malware solutions. Regular scans and real-time protection can help you detect and mitigate malicious software before it causes any damage.

6. Develop and Maintain Secure Systems and Software

Regularly updating your systems and applications is vital to protect against known vulnerabilities.

Establish a process for the timely installation of security patches. Also, prioritise secure coding practices when developing applications to minimise the risk of introducing vulnerabilities into your systems.

7. Restrict Access to System Components and Cardholder Data

Not everyone in your organisation needs access to cardholder data.

Limit access based on job roles. Follow the principle of least privilege and give employees access to the bare minimum data they need to perform their duties.

8. Identify Users and Authenticate Access to System Components

Assigning unique identification to each user ensures accountability and traceability.

Enhance security by implementing strong authentication methods, such as multi-factor authentication, which gives an extra layer of protection and ensures only authorised users gain access.

9. Restrict Physical Access to Cardholder Data

Don’t overlook the importance of physical security. Restrict access to systems and devices that store or process cardholder data to prevent unauthorised individuals from gaining access. Implement access controls, monitor entry points and secure sensitive areas to safeguard cardholder information physically.

10. Log and Monitor Access to System Components and Cardholder Data

Keeping detailed logs of all access to system components and cardholder data is crucial for detecting and responding to security incidents.

Regularly monitor and analyse these logs to identify suspicious activities. This approach allows you to address potential issues promptly.

11. Test Network and System Security Regularly

Regular testing of your security systems helps identify and address potential vulnerabilities.

Conduct vulnerability assessments and penetration testing to ensure your defences are sufficient. Establish a routine testing schedule to maintain adequate security measures.

12. Support Information Security with Organisational Policies and Programmes

A strong organisational policy is the backbone of any effective security programme.

Develop and maintain a comprehensive policy that serves as a framework for implementing and managing security measures.

Conduct regular training to ensure all employees understand their roles in protecting cardholder data.

PCI DSS Training

While technical measures are essential, staff training is equally crucial for PCI DSS compliance. Employees must understand security best practices and their role in preventing data breaches and fraud.

Our online PCI DSS Training equips staff with the knowledge to identify risks and securely handle cardholder data, both in-person and remotely. The training course helps equip staff to maintain compliance and protect sensitive information.

Investing in training helps reinforce security practices and minimises the risk of breaches, ensuring your organisation remains compliant and protected.