All businesses that handle large sums of money have duties to combat money laundering. Regulations require businesses to take a “risk-based” approach to prevent criminal proceeds from being laundered.

This guide outlines how to prevent money laundering. It covers the essential actions required by law to help you develop and implement effective anti-money laundering (AML) procedures in your organisation.

Key Takeaways

- Businesses in high-risk sectors or handling large sums of money must comply with the Money Laundering, Terrorist Financing and Transfer of Funds Regulations 2017.

- A risk-based approach is essential; identify your organisation’s vulnerabilities and focus resources where money laundering risks are highest.

- Effective AML policies, regular reviews, due diligence and staff training are critical to staying compliant and preventing money laundering.

Money Laundering in the UK

Money laundering is the process of disguising illegally obtained money by using it to buy legitimate assets, sometimes via multiple transactions to make the funds harder to trace.

Criminals are good at this. The National Crime Agency estimates that around £100 billion is laundered in the UK each year. This figure puts the UK in second place for global money laundering, only trailing the United States, which sees an estimated £216.5 billion laundered annually.

Arguably, money laundering is still a bigger problem for the UK. The £100 billion laundered on our soil each year is equivalent to about 4.5% of the country’s GDP. The US economy is considerably larger, so the £216.5 billion they see laundered “only” accounts for 1.4% of their GDP.

Part of the problem is the UK’s position as a leader in financial services. London is known as the world’s financial hub for good reason (a significant amount of that £100 billion passes through the capital). With so many legitimate transactions happening, it can be difficult to spot the illegal ones.

Successfully laundered money finds its way back into criminals’ pockets or funding further illegal activity, even terrorism. So, the government expects all businesses (and individuals) who handle large sums of money to comply with the Money Laundering, Terrorist Financing and Transfer of Funds Regulations 2017 (MLR 2017).

Money Laundering Regulations

Illicit funds are a lot harder to claw back after they’ve been cleaned, so MLR 2017 expects businesses to take steps to prevent money laundering.

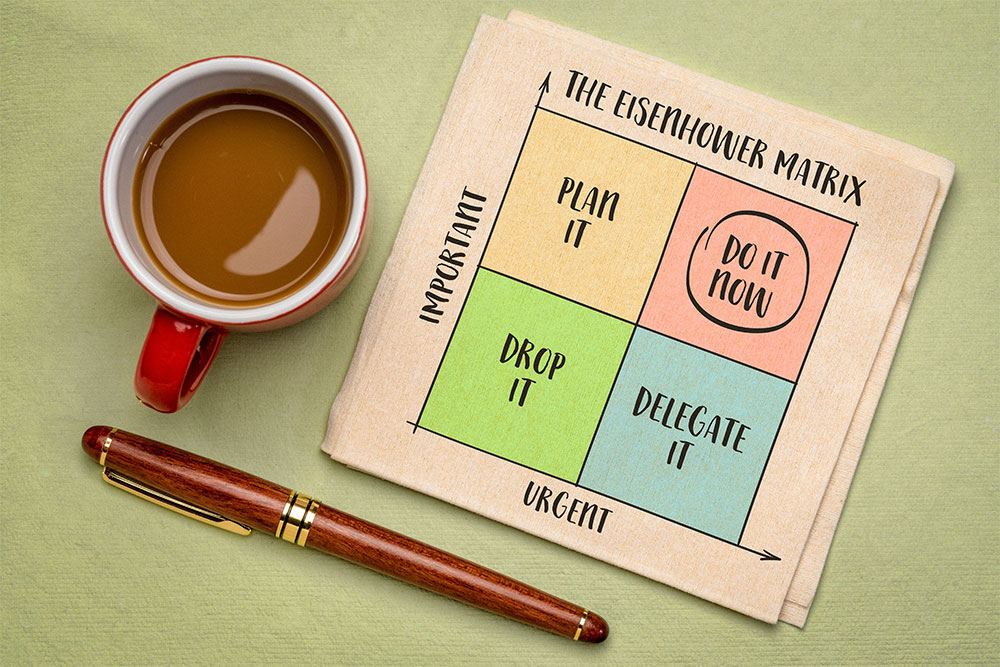

Central to compliance is the “risk-based” approach organisations must take. Effectively, you need to carry out a money laundering risk assessment.

A risk assessment is a systematic review of hazards and how they can be managed. This process is most closely associated with health and safety, but the principles can be applied to combat money laundering.

Understanding how to prevent money laundering starts with risk assessment, so we’ve outlined the steps below. But it isn’t the only strategy. You’ll also find four more components of an effective risk-based approach against money laundering.

How to Prevent Money Laundering

The steps below outline how to prevent money laundering. All of them align with the legal requirement to take a risk-based approach.

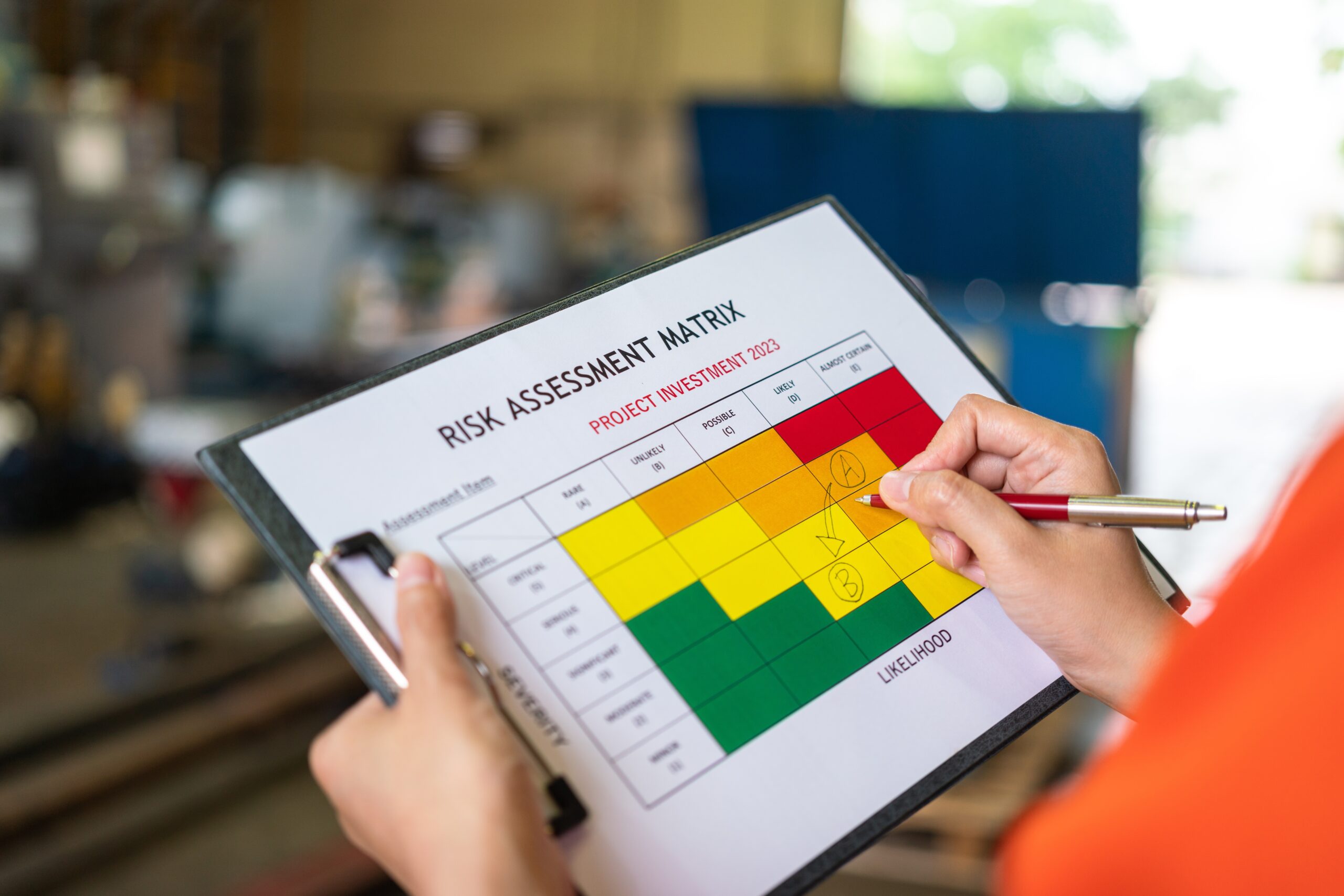

Risk Assessment

Conducting a thorough risk assessment is the first step in preventing money laundering. You need to identify areas where your business is vulnerable and implement specific measures to mitigate money laundering risks.

Key risks include:

- High-risk industries such as gambling, property and high-value goods dealing.

- Complex or unusual customer profiles, including those using offshore companies.

- Jurisdictions with weak regulations or reputations for financial secrecy or corruption. (A list of high-risk countries can be found on the government website.)

- High-value or one-off transactions, particularly if they involve cross-border payments or brokered deals.

- New clients, although all customers should be subject to some form of monitoring.

You should use this assessment to focus your AML efforts where they’re most needed.

AML Policies

A strong AML policy ensures your entire team knows their responsibilities and how to handle money laundering risks or suspicious activity.

It should include:

- Purpose and scope: Define the policy’s objectives and its relevance to your business.

- Roles and responsibilities: Clearly assign tasks and accountability for AML compliance within your organisation, including the appointment of a Money Laundering Reporting Officer (MLRO) to oversee compliance.

- Step-by-step procedures: Outline the actions staff must take to detect and prevent money laundering based on your risk assessment findings.

Regular Reviews

Money laundering risks aren’t static. Regular reviews of your risk assessments, policies and procedures are essential to keep pace with evolving threats.

You should regularly review:

- Risk assessments: Reassess risks and controls regularly and after significant changes to your business. Developments in your operations, customer base or legislation can cause new risks to emerge or invalidate existing control measures.

- AML policies and procedures: Update these to reflect the latest risk assessment and ensure they remain relevant to your business and compliant with regulations.

- Customer monitoring: Review client activity on an ongoing basis. Pay attention to unusual transactions or changes in behaviour, even for long-standing clients.

Due Diligence

Customer due diligence, also called “know your customer” (KYC), is about understanding who you’re doing business with and ensuring their activities align with your expectations. This process begins during onboarding and continues throughout your relationship with the customer.

There are three levels of due diligence:

- Simplified due diligence: Minimal checks for the lowest-risk customers, like well-known financial institutions or publicly traded companies.

- Standard due diligence: Applied to medium-risk customers who don’t qualify for simplified due diligence but aren’t flagged as high-risk. These checks are more detailed and involve verifying identity and the nature of the business relationship.

- Enhanced due diligence (EDD): Required for high-risk customers. EDD involves extensive information gathering, in-depth identity verification and approval from senior management before any transactions are finalised.

Use Technology

Technology can streamline your AML efforts. Automated systems are helpful in detecting patterns and irregularities. More importantly, they can also free up staff to oversee higher-risk transactions.

Consider using the following tools:

- Transaction monitoring software: Tracks and flags suspicious activity, such as unusual payment amounts or patterns.

- Identity verification tools: Automate customer identification and cross-reference their details against global sanctions or politically exposed persons (PEP) lists.

- Data analytics platforms: Help identify trends or anomalies that indicate money laundering risks, particularly in high-volume transactions.

- Electronic record-keeping systems: Store and organise customer data securely while ensuring it’s easily accessible for audits or regulatory reporting.

Training

Even with the best policies, tools and procedures, your staff are the frontline against money laundering. They need regular training to recognise money laundering risks, understand their responsibilities and apply AML procedures effectively.

Key areas to cover in training include:

- Identifying red flags, such as unusual customer behaviour or inconsistent transaction details.

- Following reporting protocols, including when and how to escalate concerns.

- Keeping up to date with evolving money laundering risks and regulations.

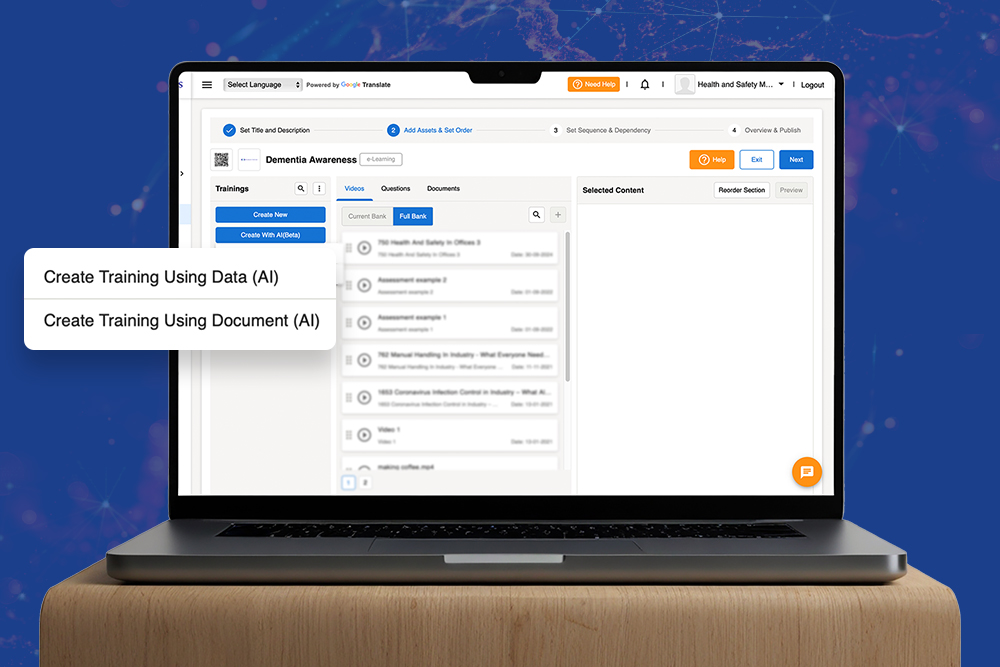

Online AML Training

Staying compliant with MLR 2017 is a legal obligation for businesses handling large sums of money. Our online Anti-Money Laundering Training provides an introduction to these regulations and equips your team with the tools they need to combat money laundering.

This course covers:

- Key steps to compliance with MLR 2017

- What to look for when assessing money laundering risks

- How to prevent money laundering and protect your organisation

And since it’s entirely online, you can assign the course and track training status across your whole team simultaneously. This feature lets you build organisation-wide awareness faster and shows that you’ve taken proactive steps to manage money laundering risks, as required by law.